November 13, 2025 11:00 am

Register now

Can your AI remember details shared during a conversation—such as location and prior questions—and use them to provide contextual answers, or do customers/members need to repeat themselves?

Can your AI suggest relevant products and services based on what customers/members ask?

Can your AI answer questions using content from your website and knowledge base, or are responses entirely scripted?

Does your AI include built-in intent, flow, and sentiment analysis to score conversations holistically?

Can your AI perform bullseye routing to the appropriate department or person based on intent, or is it limited to transferring calls to a single queue?

Does your AI provide Next Best Action prompts to help complete tasks, or does it rely on customers/members to ask the right follow-up questions?

Can your AI use goal-based reasoning to help customers/members make financial decisions (e.g., buying a big-ticket item, calculating monthly loan payments)?

Can your AI repeat key information—automatically or on demand—to help a distracted customer/member continue the conversation?

Can your AI trigger real-time escalation to human agents based on signals such as anger, frustration, or potential fraud risk?

Does your AI support custom voices, such as the voice of one of your employees or a brand-associated celebrity?

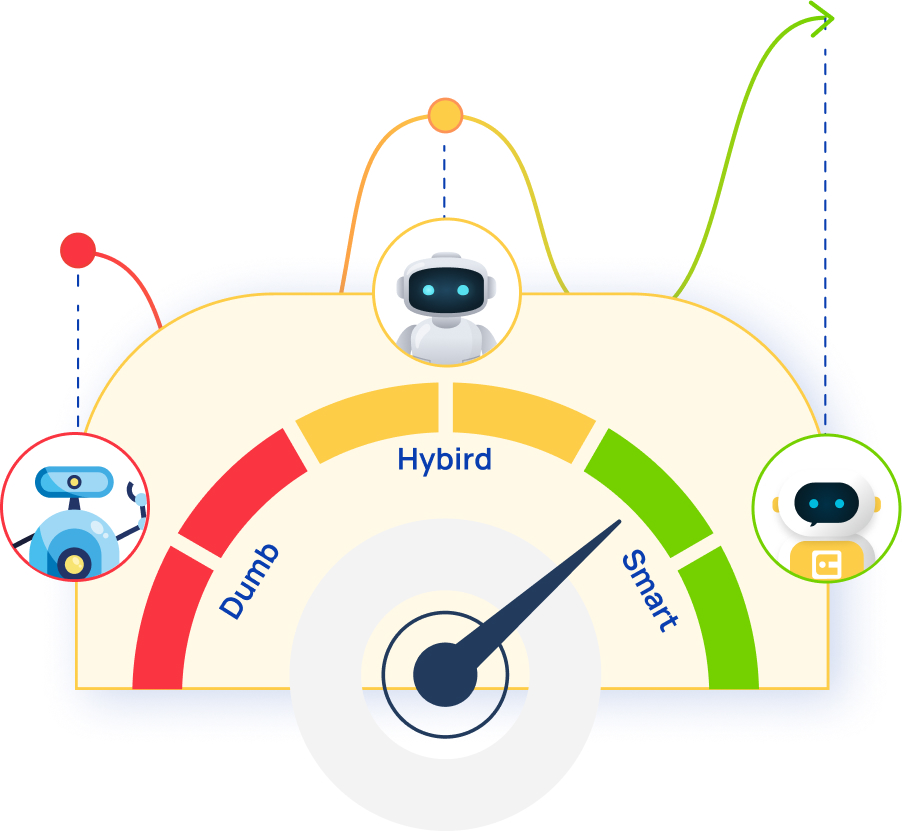

You’ve taken steps toward smarter automation, but gaps remain. Without deep banking context, compliance guardrails, and full voice/chat parity, you risk stalled adoption and member/customer frustration. Now’s the time to upgrade before costs and call volumes rise.

Your current AI is an “answer engine” that talks but doesn’t act. It deflects instead of resolving, lacks compliance controls, and can’t scale with demand. That creates hidden costs, service gaps, and regulatory risk. The good news? You can fix this—fast—with vertical, agentic AI that resolves real tasks end-to-end.

You’ve taken steps toward smarter automation, but gaps remain. Without deep banking context, compliance guardrails, and full voice/chat parity, you risk stalled adoption and member/customer frustration. Now’s the time to upgrade before costs and call volumes rise.

You’ve got (or are ready for) banking-specific, agentic AI. It authenticates, acts, and resolves—across both voice and chat—with compliance built in. This is what separates institutions that scale confidently from those stuck in pilot mode.