Home

“Understood me the first time, every time.”

“It felt like chatting with my favorite banker.”

“Escalated at the perfect moment.”

“Support feels smarter each week.”

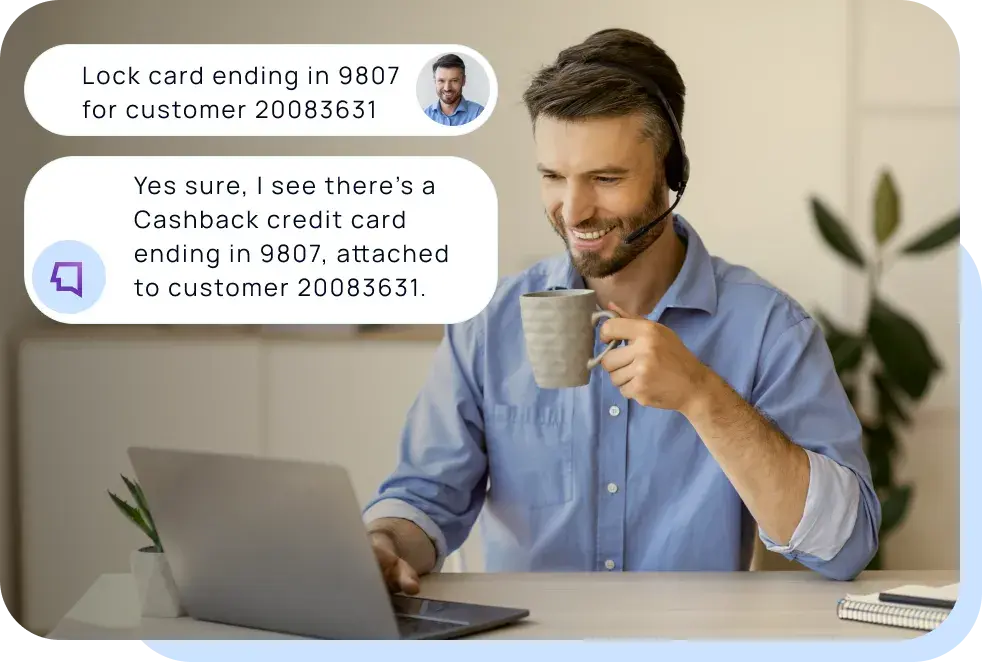

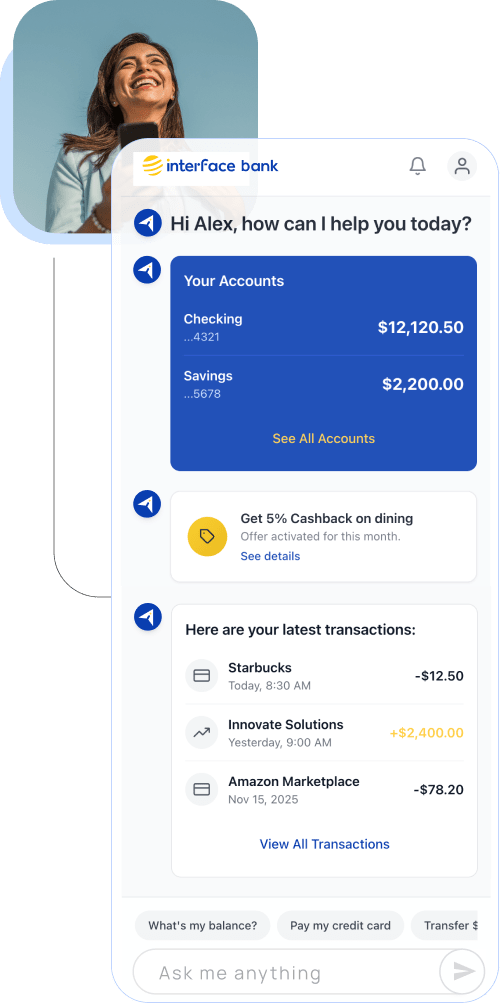

Your banking chatbot feels like a 24/7 personal teller. It guided me through a wire transfer, verified details twice, and finished everything faster than visiting a branch.

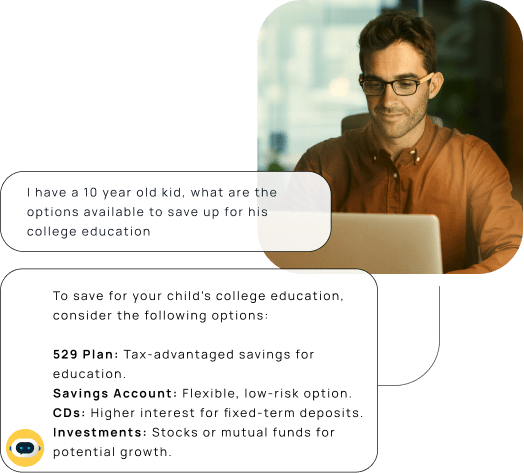

“I explained my situation once and it picked up every detail on the first try. Then it walked me through the exact steps—no guessing, no menu maze. I was done before I would’ve reached a human in the old system.”

“Showed me the best card for my spend.”

“Got me to the right expert on the first try.”

“It suggested the exact step I needed.”

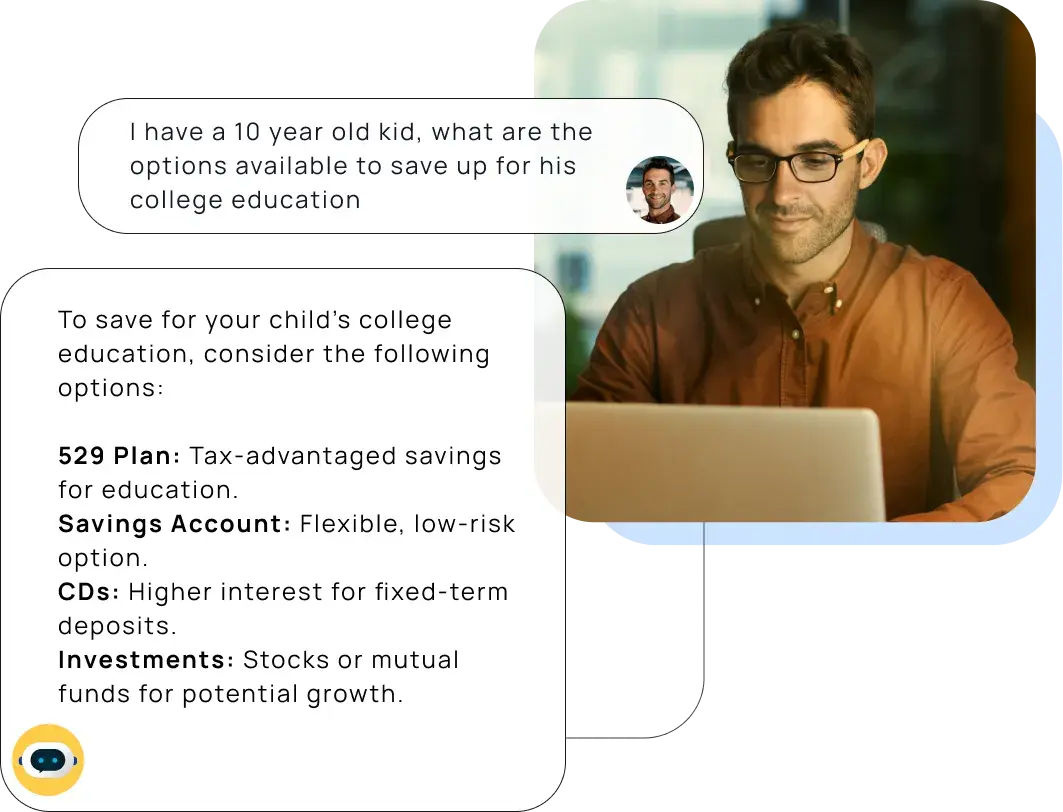

The banking chatbot helped me open a savings account, compare interest options, and set automated transfers. It explained everything clearly, so I felt confident about every step of the process.

“It remembered my last issue and picked up where we left off.”

“Explained policy in plain English.”

“Knew my preferences and limits.”

“Didn’t make me repeat account details.”

“Got me to the right expert on the first try.”

“No more blind transfers.”

“Showed me the best card for my spend.”

During an overseas trip, the chatbot quickly unblocked my card, confirmed my identity, and updated travel notes. No calls, no forms—just fast, secure help right when I needed it.

“No menus—just a natural conversation.”

“They spotted a trend and updated my plan.”

“No copy-paste—actual solutions.”

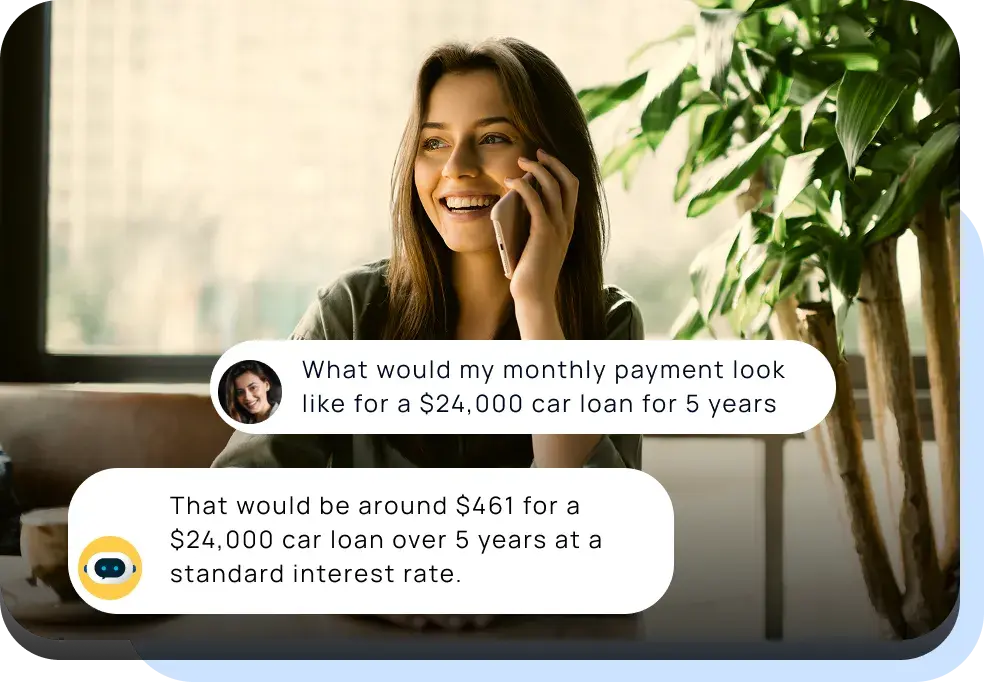

“Handled my loan questions perfectly.”

The chatbot answered my loan questions instantly, flagged a suspicious transaction, and even helped reset my PIN. It’s like having a patient banker in my pocket.

I love how the chatbot explains banking terms in plain language. It tracked my EMI schedule, reminded me of due dates, and helped me avoid late fees during busy months.

“Showed me the best card for my spend.”

“Feedback turns into action now.”

Resolved my issue in one nudge.

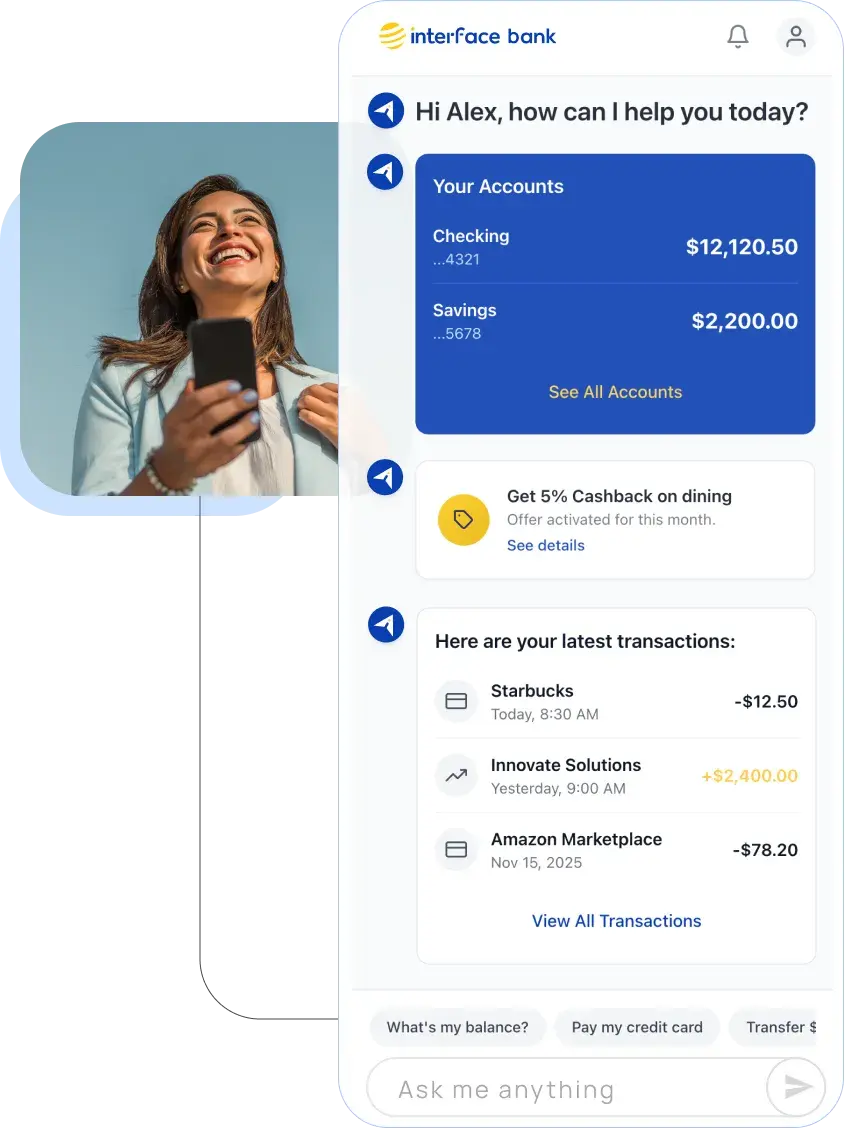

Previous AI delivered responses. Agentic AI delivers resolutions.

The only platform with financial-grade compliance built into every interaction. We train on NCUA and FFIEC regulations to automatically detect violations and restrict risky content instantly.

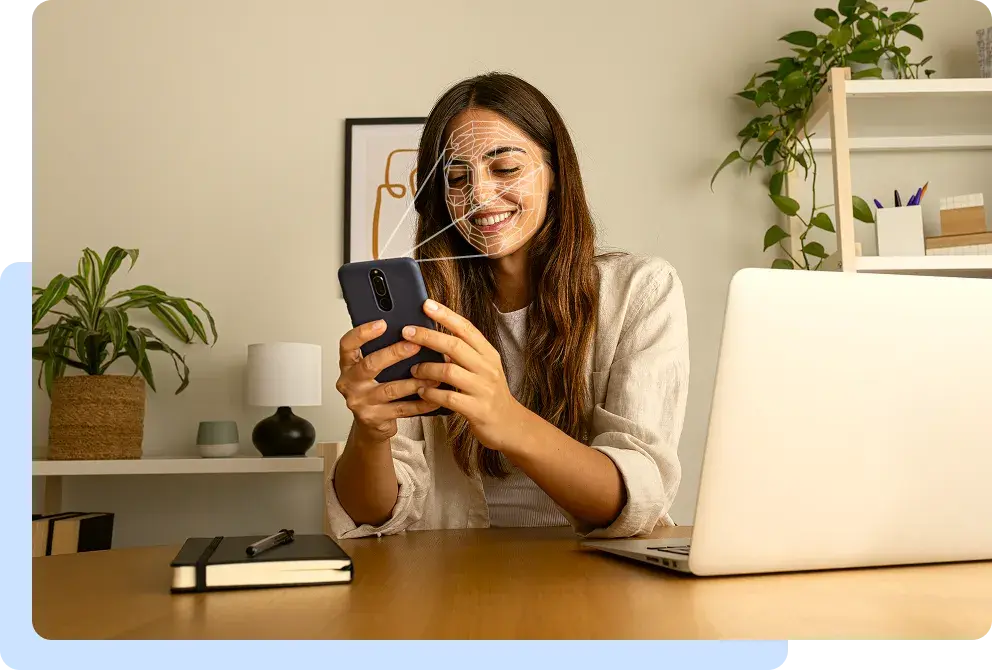

Balance protection with convenience. From biometric verification to adaptive risk-based authentication, we offer the industry’s broadest security capabilities without slowing down the member experience.

Turn conversations into strategy. AI-powered call summaries and sentiment analysis provide deep visibility into customer feedback and document usage.

Build, test, and manage with confidence. Our unified dashboard offers role-based access, advanced LLM routing, and seamless SSO integration for complete administrative power.