Not All AI is Equal – A Framework for Evaluating Banking AI Agents

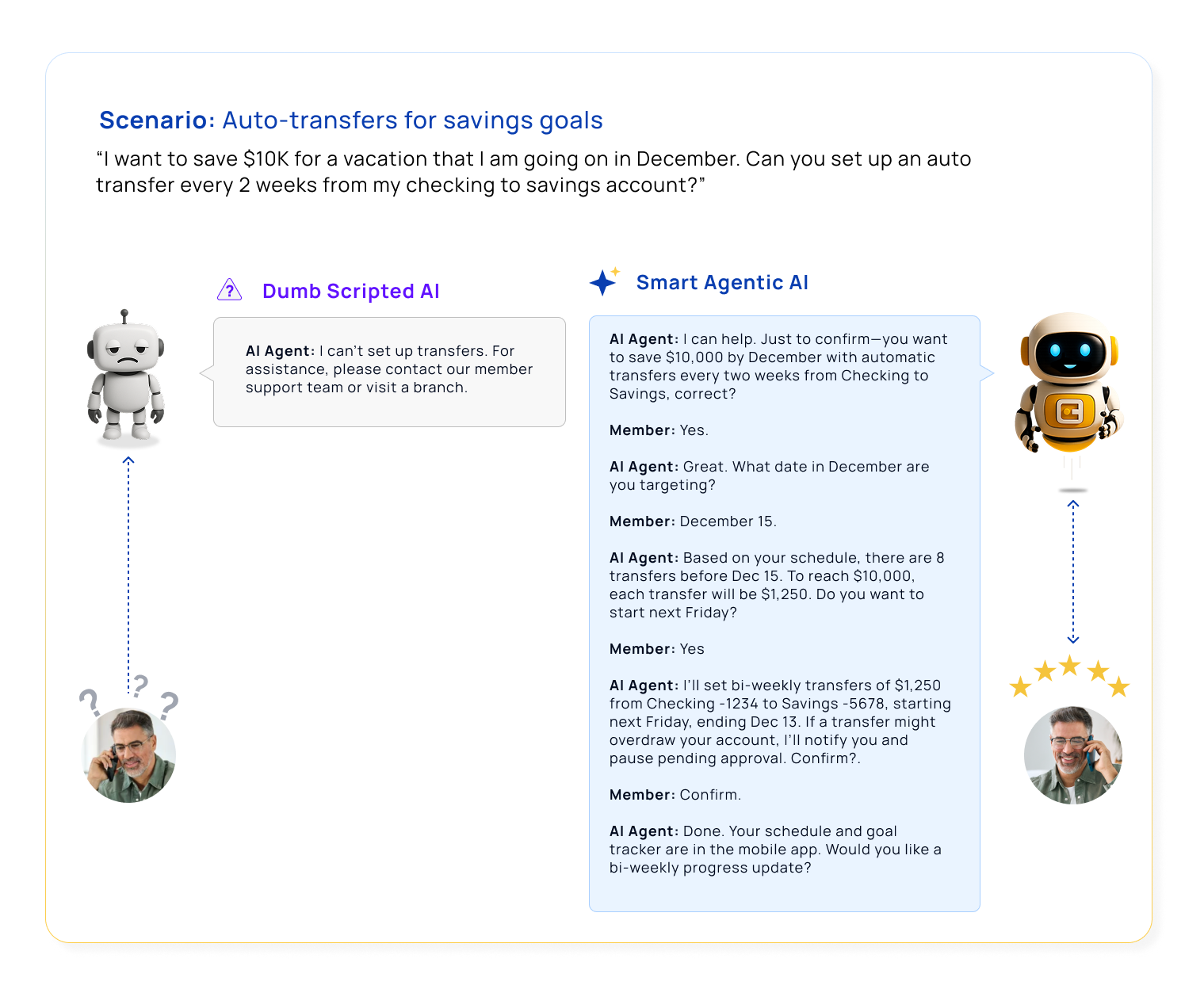

For years, banks and credit unions have been promised “AI” that would transform service. But in reality, much of what’s been delivered are scripted bots in disguise. They look polished in a demo, but in practice they operate like digital decision trees – rigid, repetitive, and unable to handle the complexity and unpredictability of real financial conversations.

Agentic AI couldn’t be more different. Instead of being trapped in static scripts, agentic AI agents understand intent, carry context across conversations, and adapt responses in real time. They’re built to handle the nuances of banking and deliver answers that feel human.

In other words, scripted bots act as junior human agents, agentic AI acts like a senior human agent that handles conversations with nuance, deep understanding and empathy that feels magical. You can see the stark difference for yourself in this AI comparison simulator.

But how can you separate true agentic AI agents from scripted bots dressed up with modern labels? That’s why leaders need a clear evaluation framework – to know their AI can handle real conversations, not just scripted demos.

A Framework for Evaluating Banking AI Agents

To separate scripted bots from agentic AI, banking leaders should evaluate every AI solution against these ten essential questions. Together, these determine whether an AI agent can truly deliver on its promises, or simply add another layer of friction.

1. Can it remember context across conversations?

Agentic AI can recall details like location, account type, or prior questions without forcing customers to repeat themselves. Scripted bots reset with every interaction, creating frustration and wasted time.

How to test: Provide the AI with your location early in the conversation, then reference it later. A true agent should recall it without asking again.

2. Can it recommend relevant products and services?

Agentic AI agents don’t just answer routine FAQs. It can act like a financial guide, surfacing tailored products and services based on the individual’s data and conversion history. Scripted bots stop at surface-level answers.

How to test: Ask the AI about creating a savings plan for a child. An agentic AI should recommend a 529 plan or equivalent product, not stop at a generic response

3. Can it learn from your knowledge base, not just scripts?

Agentic AI can tap into your website, FAQs, and internal resources to provide accurate, up-to-date answers. Scripted bots can only regurgitate preprogrammed lines, limiting conversations and resolution rates.

How to test: Ask a long-tail question that should be answered from website content, such as “When was the credit union founded?”

4. Does it evaluate conversation quality holistically?

Advanced agentic AI can score conversations using built-in intent recognition, flow tracking, and sentiment analysis. This provides leaders with insight into customer satisfaction and unmet needs. Most scripted bots offer little more than completion rates.

How to test: Review the agent’s analytics. A real AI agent should provide conversation scoring and qualitative insights.

5. Can it route with precision?

“Bullseye routing” sends customers directly to the right department or expert based on the conversations and needs. Scripted bots usually funnel everyone into the same queue, increasing call transfers and inefficiency.

How to test: Request transfers to different departments. A strong AI agent should route you directly, not drop you in a general service pool.

6. Does it guide the journey with next best actions?

Rather than relying on customers to ask the perfect follow-up question, agentic AI agents proactively prompts the next step – whether completing an application or exploring new options. Scripted bots wait passively for the right keyword, creating an experience that feels more mechanical than human, as well as missing out on cross/upsell opportunities.

How to test: See if the AI agent follows up with prompts like “Would you like to…?” or “Can I help you with…?”

7. Can it support real financial decision-making?

From calculating loan payments to weighing big purchases, advanced agentic AI can reason through goals with customers. Scripted bots simply can’t. Known as goal-based reasoning, this separates true AI advisors from mere assistants.

How to test: Ask, “I’m planning to buy a $40,000 car. What would my monthly payment be?” A capable AI agent should calculate and guide.

8. Can it repeat and recap key information?

Agentic AI can repeat terms, balances, or instructions automatically or on demand, keeping customers on track if they’re distracted. Scripted bots usually force the customer to start over.

How to test: Ask the AI to recap key details from earlier in the conversation. A true AI agent should recall and restate accurately.

9. Does it escalate intelligently?

Agentic AI agents can sense when a customer is struggling – whether through confusion, repeated questions, or rising frustration – and escalate seamlessly to the right human representative in real time. Scripted bots, by contrast, escalate clumsily, often only after the customer has tried multiple times, hit a dead end, or simply given up

How to test: Express frustration, e.g., “I see a fraudulent charge on my card.” The AI should escalate seamlessly to the appropriate agent.

10. Can it embody your brand voice?

The best AI supports custom voices, whether an employee, trusted advisor, or brand ambassador. Scripted bots more often than not sound mechanical and impersonal.

How to test: Evaluate the AI’s tone in responses. Does it reflect your institution’s voice, or does it feel generic and robotic?

The Bottom Line

The real challenge for leaders is knowing which kind of AI they’re buying. Labels can be misleading, and flashy demos don’t always reveal limitations. A clear evaluation framework ensures institutions choose solutions that truly fit the realities of financial services.

To learn more about AI in banking and the critical differences, explore the complete AI learning hub for credit union and banking leaders. From an AI comparison simulator to an AI health check quiz, the hub offers hands-on tools and insights to drive your AI journey on with confidence.

Because when every interaction shapes trust, not all AI is equal. Smart AI, like a smart human employee, makes all the difference!

AI Insights for Credit Union & Community Bank Leaders

Join the monthly newsletter for all the latest industry updates