November 13, 2025 11:00 am

Register now

Experience the future of customer & member engagement with a groundbreaking Voice AI solution tailored for banks and credit unions.

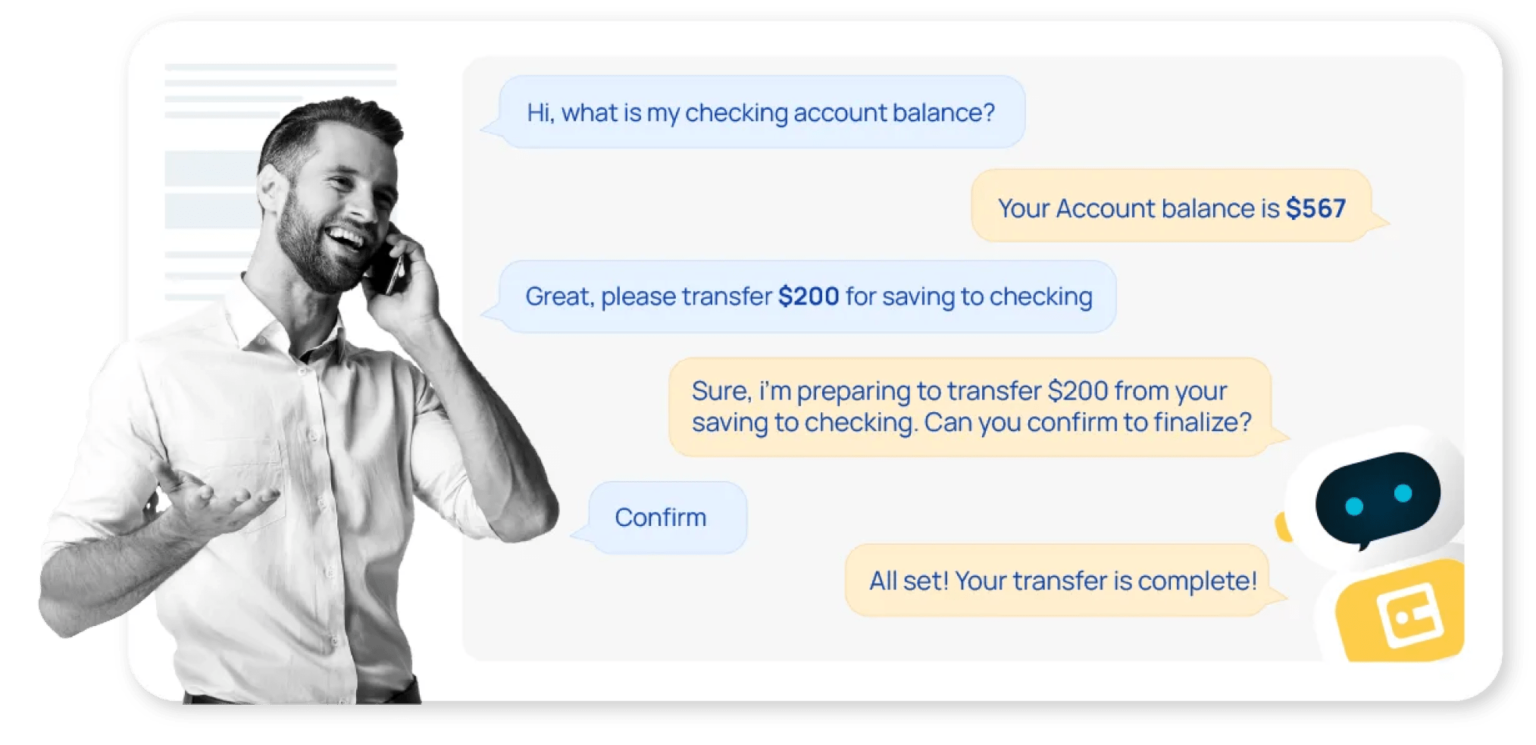

Voice AI redefines phone‑based service, delivering lightning‑fast, human‑like conversations that streamline everyday requests, while driving down contact‑center costs.

Acting as the first point of contact, it resolves routine inquiries with exceptional accuracy and speed, then seamlessly hands off complex or sensitive matters to human agents, complete with full context. This blend of AI automation and agent expertise empowers institutions to boost satisfaction, cut wait times, and build a scalable service model.

From Day 1, the bot efficiently handles 100% of incoming calls, eliminating wait times for members & significantly reducing call abandonment rates.

Available round-the-clock, eliminating the need for after-hours or overflow services. This significantly reduces costs, while improving customer satisfaction.

Resolves up to 45% of calls in the first month, with a goal of automating 60%+ soon after, boosting efficiency and reducing operational workload.

Automation handles the simpler tasks to free up staff to focus on complex and sensitive cases. This improves service quality and reduces staffing strain.

Eliminates after-hours or outsourced support by automating key transactions, delivering continuous 24/7 service without the need for outsourcing staff.

Eliminates wait times and completely reduces abandonment rates, ensuring customers receive immediate assistance and enhancing overall satisfaction.

Reduce average handling time by providing agents with full conversation context and authentication details, saving 60 to 90 seconds per call.

Provides instant,passive validation of the caller’s identity by analyzing phone signals and metadata to detect spoofing and ensure secure interactions.

Delivers a personalized experience by adapting to individual preferences and needs, fostering stronger customer relationships & increasing satisfaction.

Drives additional revenue by naturally recommending products or services that are relevant to the caller, increasing customer satisfaction.

Provides actionable insights into AI performance, empowering businesses to make informed decisions and optimize engagement strategies for better results.

Delivers seamless and secure authentication through fingerprint or facial recognition on the user’s device—ensuring privacy without storing or sharing biometric data.

Delivers natural, human-like speech for smoother, more engaging interactions that resolve queries.

Create a unique, branded voice for your AI system by simply providing a short voice sample.

Advanced speech recognition that comprehends user input with greater accuracy than agents.

Real-time fraud detection, analyzing 35+ risk factors to block fraud calls even reaching agents.

Seamless, personalized transfer to human agents for a smooth, quick and frictionless experience.

Customizable analytics dashboards for deep insights into performance & value of AI interactions.

Respond with a combination of voice and text as needed to provide a better user experience.

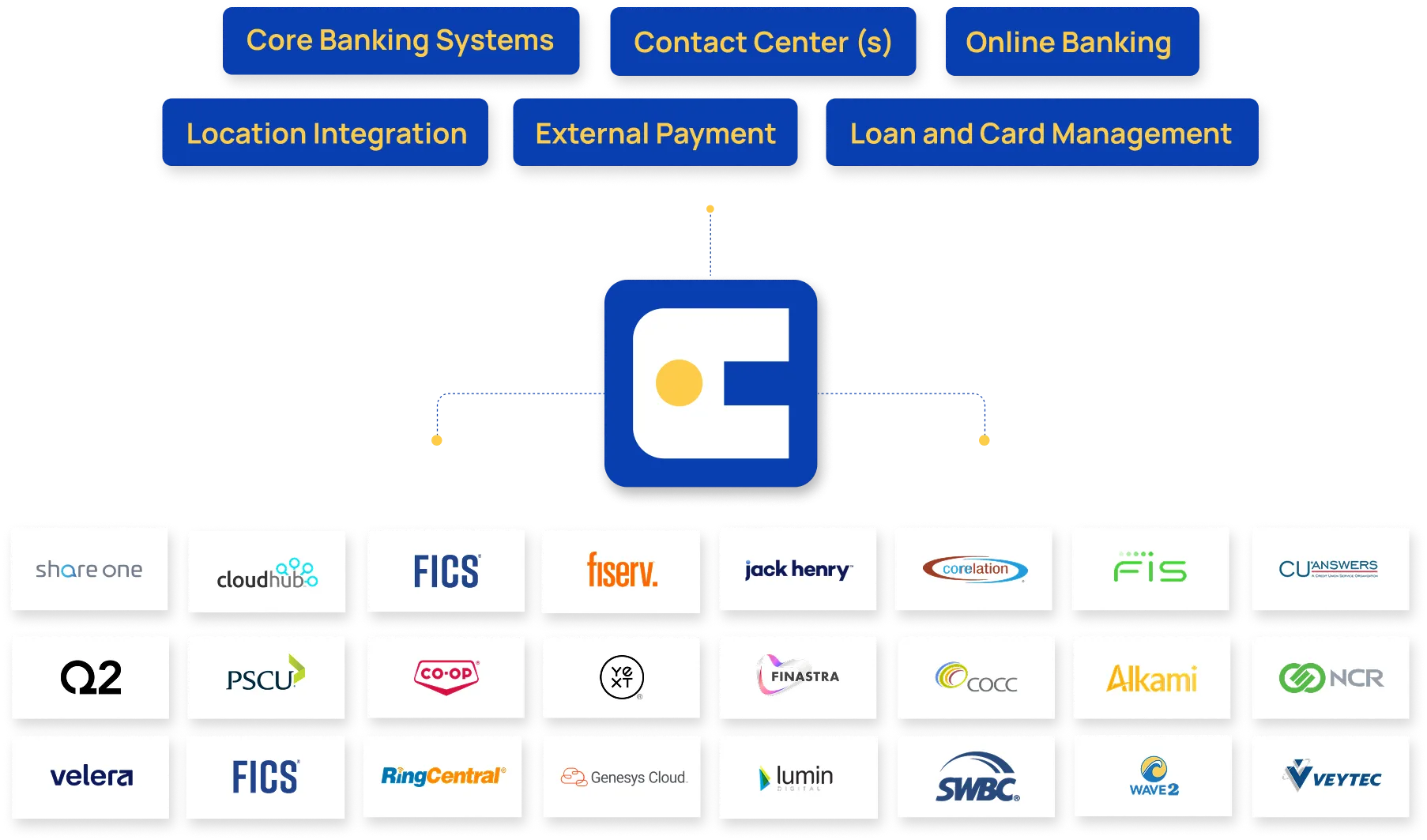

Integrates with core banking, loan origination, CRM and knowledge management software.

Risk-based authentication that combines AI, device biometrics, caller ID forensics, and much more.

Chat AI Platform Prebuilt to Work with Banking Systems from Day 1