Home » Chat AI

interface.ai’s three‑pronged Agentic Chat AI solution is purpose‑built for banks and credit unions, fusing agentic AI, secure transaction handling, and AI-powered form assistance into one seamless experience.

By delivering natural, unscripted engagement that never hits a dead end, customers and members can complete everyday tasks, 24/7, while also improving form completions. When a conversation needs human insight, the Agentic Chat AI seamlessly hands off the chat and full context to an agent.

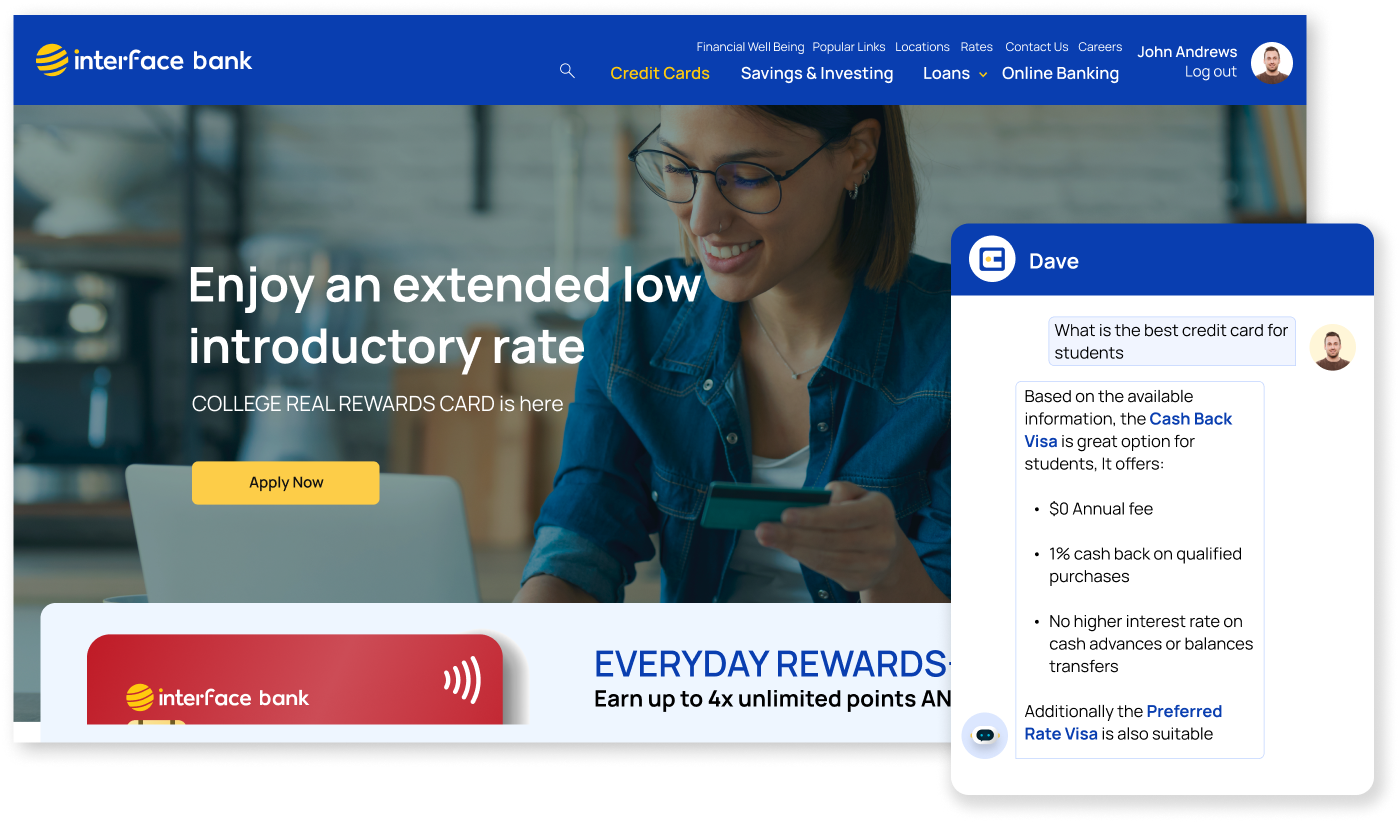

Your always-on digital assistant powered by end-to-end grounded generative AI and agentic AI. Instantly answer questions, surface the right products, and guide users on your website and mobile app with a multi-modal experience.

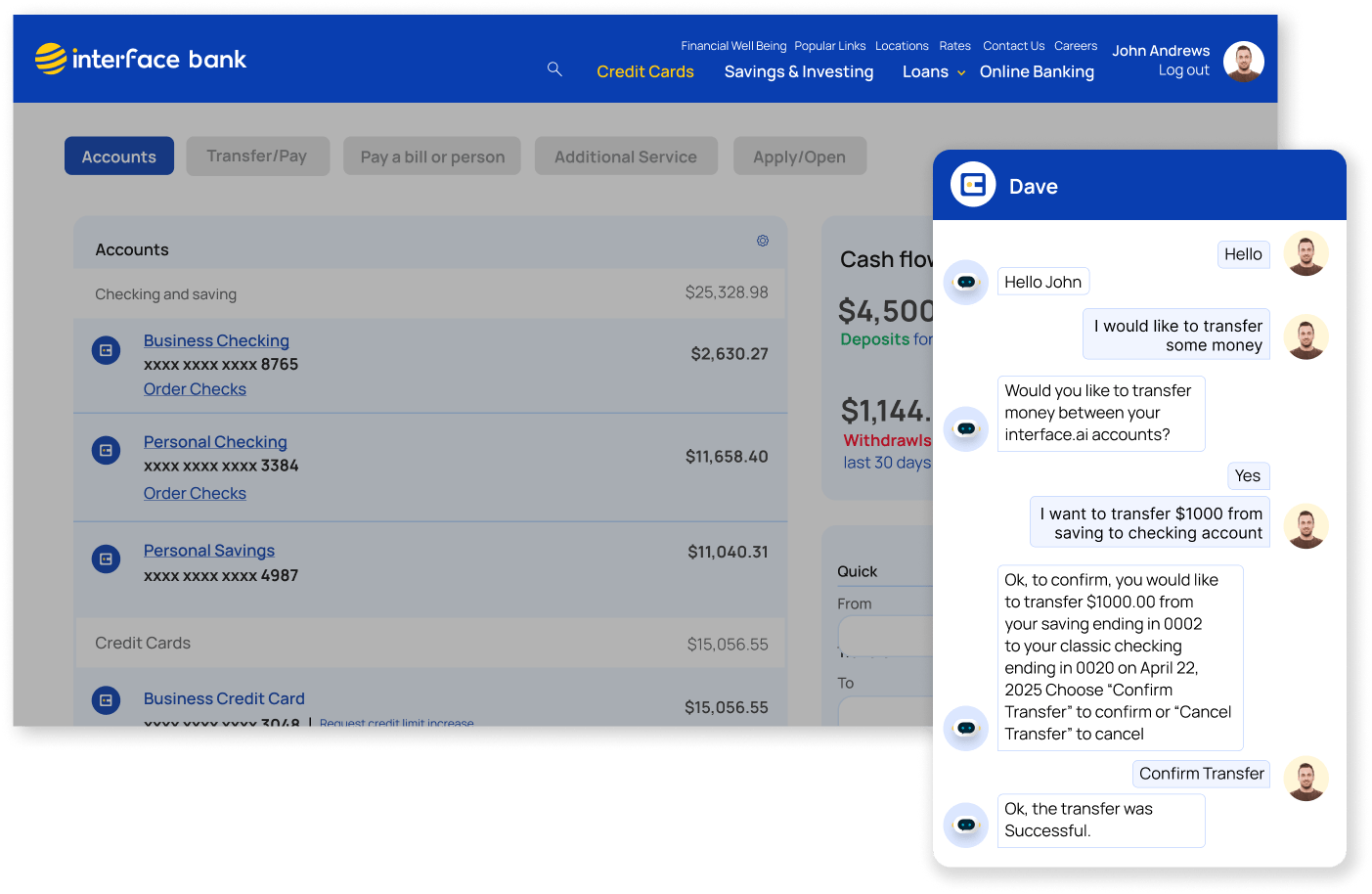

A phone banking-equivalent experience on website and mobile app, enabling users to manage their finances, transfer funds, make payments, and monitor their accounts - independently, securely, and without hassle.

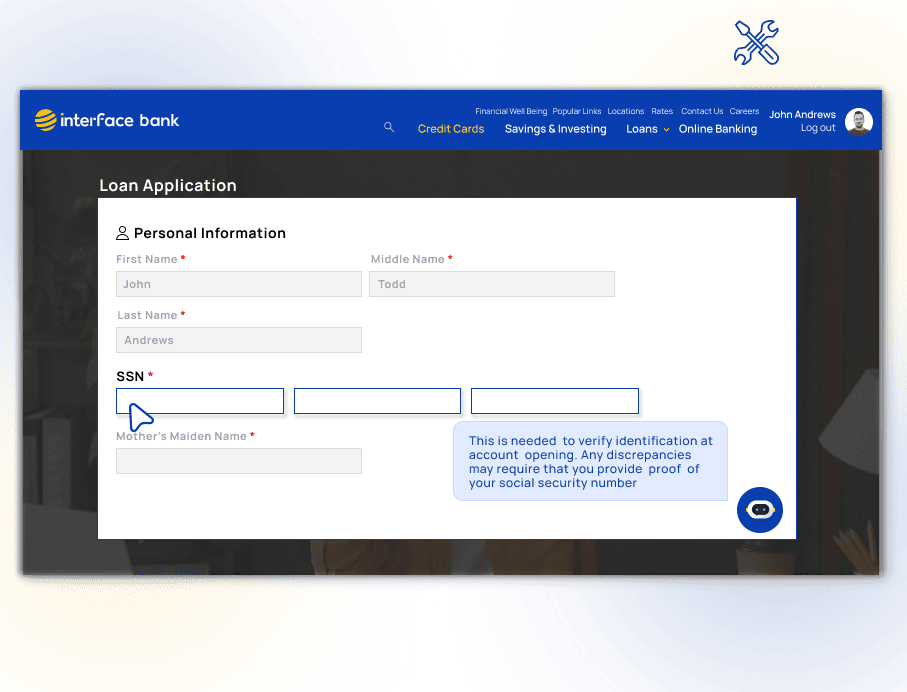

Real-time co-browsing and contextual support that turns prospects into customers. Guide users through complex forms and onboarding steps with ease, reducing drop-offs and skyrocketing your application conversion rates.

AI Search is a Generative AI-powered, informational Chat AI Agent designed to provide personalized, contextual responses to user queries. It delivers accurate answers by dynamically pulling knowledge from your website and shared documents, eliminating the need for manual training or maintenance.

Instant, accurate responses eliminating wait times, boosting satisfaction and engagement.

Point it to your site and it picks up all the info it needs - no complex setup or manual training.

Automatically refreshes knowledge from your website & docs — daily, weekly, or on demand.

Runs on desktop, mobile browsers, or as a lightweight progressive web app (PWA).

Deliver personalized, human-like conversation, powered by a deep understanding of user intent and context.

The AI dynamically learns from your website or files so you never need to manually update or build workflows.

Delivers personalized answers with source links that auto-scroll and highlight the key info – no searching needed.

Instantly reflects content and policy changes, reducing the manual effort to keep info accurate and current.

Track performance, analyze user behavior, and uncover content gaps for continuous improvement.

Effortlessly transfers chats to agents with full conversation context, ensuring smooth handoffs and faster resolution.

AI Transactions brings real-time, intelligent banking into your digital channels. Members and customers can check balances, transfer funds, make payments, and manage finances from one intuitive, 24/7 interface. Designed to mirror the in-branch experience, it turns everyday transactions into seamless and secure conversations across web and mobile.

Users interact through natural language to complete tasks — no menus, no clicks. Just fast, intuitive conversations.

All products share a unified intelligence layer — enabling faster updates, consistent behavior, and shared learning across solutions.

Real-time insights into sentiment, authentication outcomes, and user behavior help improve digital experiences.

Complex banking actions are streamlined into a single step, dramatically reducing time and effort for end users.

Perform actions like transfers, bill payments, and transaction checks through simple text commands.

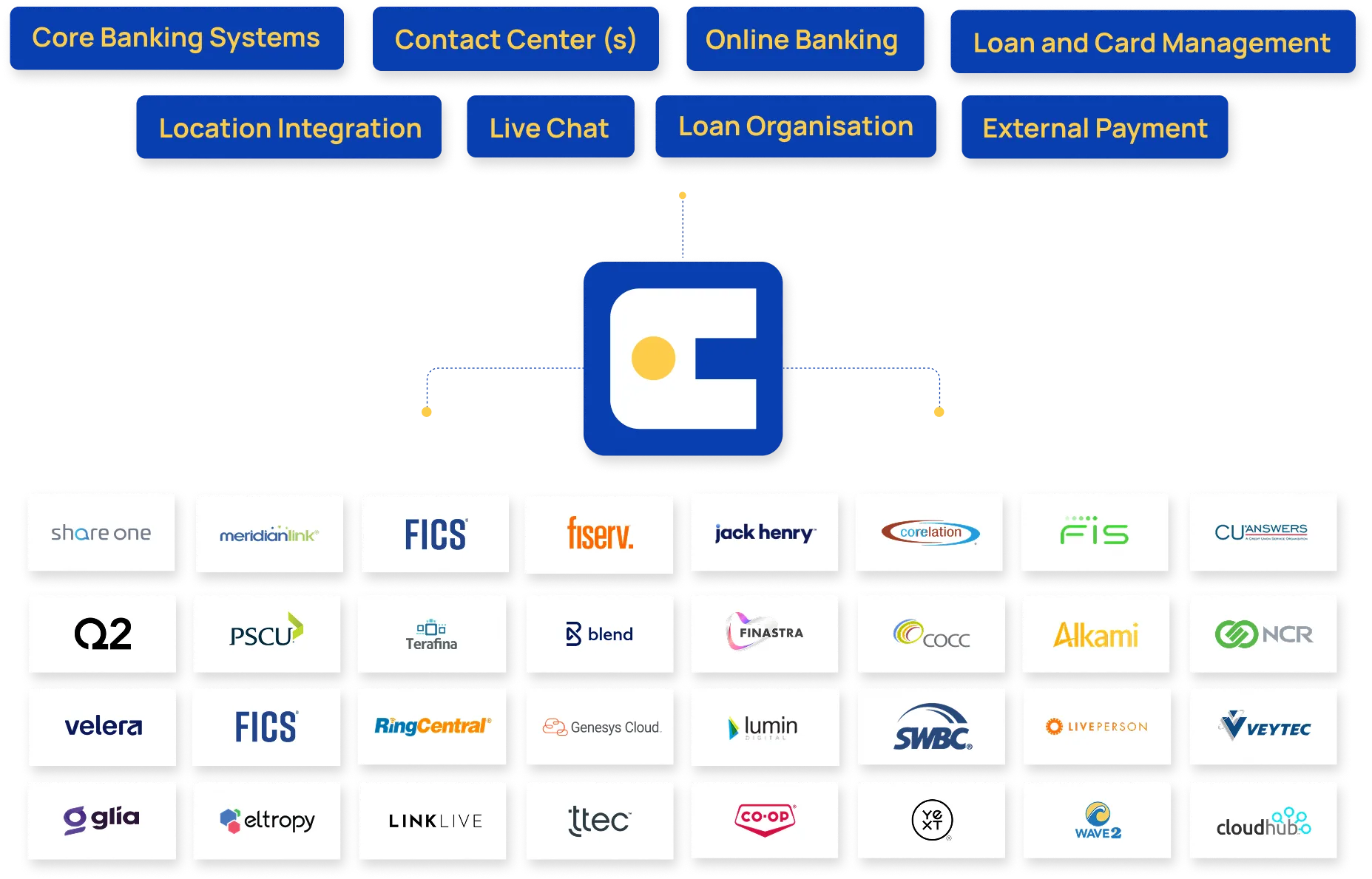

Connect instantly with core banking systems and third-party apps through out-of-the-box integrations.

Tracks sentiment, journeys, and authentication to continually improve performance.

Supports device biometrics for fast, secure, and seamless authentication during high-trust transactions.

Central knowledge base ensures updates and enhancements apply instantly across all solutions.

Connects with a dynamic knowledge base, eliminating manual configuration & powering smarter responses.

AI Conversion simplifies complex onboarding and application journeys with real-time, contextual support at every step. Using intelligent co-browsing and proactive guidance, it eliminates confusion, reduces drop-offs, and keeps users engaged—turning complex forms into completed applications and boosting conversion rates.

Real-time co-browsing paired with contextual tips delivers hands-on support through complex workflows - eliminating confusion and empowering users to complete tasks.

Leverages conversation analytics to uncover where users disengage - informing long-term improvements in journey design, content strategy, and overall experience.

Identifies points of hesitation and provides timely and contextual guidance - helping users move forward and successfully complete their applications.

Combine real-time co-browsing with in-flow contextual prompts to guide users through complex workflows, and increase task completion.

Engages users based on behavior or inactivity, while answering direct questions – keeping prospects on track throughout the journey.

Surfaces abandonment points & user behavior trends, providing actionable insights to optimize application flows and content strategy.

Banking AI platform prebuilt to work with banking systems from day 1